Annuities

Annuities can sometimes play a role in the management of your wealth. However, they are frequently misunderstood and require careful analysis prior to investment, and there are many different types of annuities. You can discuss the benefits and disadvantages with your Wealth Alliance Advisor prior to investing in an annuity.

What is An Annuity?

Individuals hold about $2.0 trillion in annuity contracts; a tidy sum considering an estimated $7.9 trillion is held in all types of IRAs.[1]Investment Company Institute, 2016

Annuity contracts are purchased from an insurance company. In exchange, the insurance company makes regular payments to the buyer — either immediately or at some date in the future. These payments can be made monthly, quarterly, annually, or as a single lump-sum. Annuity contract holders can opt to receive payments for the rest of their lives or for a set number of years.

The money invested in an annuity grows tax-deferred. When the money is withdrawn, the amount contributed to the annuity will not be taxed, but earnings will be taxed as regular income. There is no contribution limit for an annuity.

Two Types of Annuities

There are two main types of annuities.

Fixed annuities offer a guaranteed payout, usually a set dollar amount or a set percentage of the assets in the annuity.

Variable annuities offer the possibility to allocate premiums between various subaccounts. This gives annuity owners the ability to participate in the potentially higher returns these subaccounts have to offer. It also means that the annuity account may fluctuate in value.

Indexed annuities are specialized variable annuities. During the accumulation period, the rate of return is based on an index.

Fast Fact: Fine Print

Since variable annuities give you the option to allocate your premium between various subaccounts, it’s important to read the prospectus before you invest.

Annuity Restrictions

Annuities have contract limitations, fees, and charges, including account and administrative fees, underlying investment management fees, mortality and expense fees, and charges for optional benefits. Most annuities have surrender fees that are usually highest if you take out the money in the initial years of the annuity contact. Withdrawals and income payments are taxed as ordinary income. If a withdrawal is made prior to age 59½, a 10% federal income tax penalty may apply (unless an exception applies). The guarantees of an annuity contract depend on the issuing company’s claims-paying ability. Annuities are not guaranteed by the FDIC or any other government agency.

Variable annuities are sold by prospectus, which contains detailed information about investment objectives and risks, as well as charges and expenses. You are encouraged to read the prospectus carefully before you invest or send money to buy a variable annuity contract. The prospectus is available from the insurance company or from your financial professional. Variable annuity subaccounts will fluctuate in value based on market conditions, and may be worth more or less than the original amount invested when the annuity expires.

Case Study: Robert’s Fixed Annuity

Robert is a 52-year-old business owner. He uses $100,000 to purchase a deferred fixed annuity contract with a 4% guaranteed return.

Over the next 15 years, the contract will accumulate tax deferred. By the time Robert is ready to retire, the contract should be worth just over $180,000.

At that point the contract will begin making annual payments of $13,250. Only $7,358 of each payment will be taxable; the rest will be considered a return of principal.

These payments will last the rest of Robert’s life. Assuming he lives to age 85, he’ll eventually receive over $265,000 in payments.

Robert’s annuity may have contract limitations, fees, and charges, including account and administrative fees, underlying investment management fees, mortality and expense fees, and charges for optional benefits. His annuity also may have surrender fees that would be highest if Robert took out the money in the initial years of the annuity contact. Robert’s withdrawals and income payments are taxed as ordinary income. If he makes a withdrawal prior to age 59½, a 10% federal income tax penalty may apply (unless an exception applies).

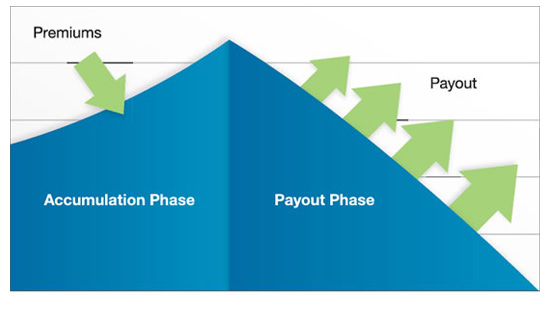

Deferred Annuity: Two Phases

Deferred annuity contracts go through two distinct phases: accumulation and payout. During the accumulation phase, the account grows tax deferred. When it reaches the payout phase, it begins making regular payments to the contract owner — in this case annually.

Annuity Comparison

Deposits into an annuity are not tax-deductible; however, you may not have to pay taxes on the interest earned until you begin making withdrawals. This tax-deferral period can have a dramatic effect on the growth of an investment.

1. Investment Company Institute, 2017

Immediate vs. Deferred Annuities

Despite not being as well known as some other retirement tools, annuities account for 8% of all assets earmarked for retirement. With about $2 trillion in assets, annuities hold more funds than Roth IRAs.¹

An annuity is a contract with an insurance company. In exchange for a premium or a series of premiums, the insurance company agrees to make regular payments to the contract holder. The funds held in an annuity contract accumulate tax deferred.

For individuals interested in accumulating retirement assets, annuities can be attractive because they are not subject to contribution limits, unlike most other tax-deferred vehicles. In other words, retirement-minded individuals can set aside as much money as they would like into an annuity.

Investment Company Institute, 2016

Annuity contracts: Two Phases

The funds attributed to the initial premium will not be taxed, but any earnings on those funds will be taxed as regular income.

Immediate Annuity

Deferred Annuity

Annuities have contract limitations, fees, and charges, including account and administrative fees, underlying investment management fees, mortality and expense fees, and charges for optional benefits. Most annuities have surrender fees that are usually highest if you take out the money in the initial years of the annuity contact. Withdrawals and income payments are taxed as ordinary income. If a withdrawal is made prior to age 59½, a 10% federal income tax penalty may apply (unless an exception applies). The guarantees of an annuity contract depend on the issuing company’s claims-paying ability. Annuities are not guaranteed by the FDIC or any other government agency.

Variable annuities are sold by prospectus, which contains detailed information about investment objectives and risks, as well as charges and expenses. You are encouraged to read the prospectus carefully before you invest or send money to buy a variable annuity contract. The prospectus is available from the insurance company or from your financial professional.

Variable annuity subaccounts will fluctuate in value based on market conditions and may be worth more or less than the original amount invested if the annuity is surrendered. For retirement-minded investors, annuities have some attractive features that may be worth exploring. Annuities also have certain limitations and expenses that need to be considered before committing to a contract.

Fast Fact: Well Prepared

7 in 10 baby boomers who own annuities have saved at least $100,000 for retirement, compared to only half of those who don’t own any.

Source: Insured Retirement Institute, 2016

References

| ↑1 | Investment Company Institute, 2016 |

|---|