Charitable Giving

Incorporating Charitable Giving into Your Financial Plan

When you’re passionate about a cause, philanthropy can be a powerful way to make a positive impact. You give because you want to, and that’s how it should be. But, with some careful navigation of the giving process, you can help maximize the effectiveness of your gifts.

Let your Wealth Alliance Advisor assist you with incorporating charitable giving into your overall financial plan.

Trends In Charitable Giving

According to Giving USA 2016, Americans gave an estimated $373.25 billion to charity in 2015. That’s the highest total in more than 60 years since the report was first published by the Giving USA Foundation in 2016.

Americans give to charity for two main reasons: To support a cause or organization they care about, or to leave a legacy through their support.

When giving to charitable organizations, some people elect to support through cash donations. Others, however, understand that supporting an organization may generate tax benefits. They may opt to follow techniques that can maximize both the gift and the potential tax benefit.

Charitable Choices Review

Direct Gifts

Charitable Gift Annuities

Pooled-income Funds

Gifts in Trust

Using a trust involves a complex set of tax rules and regulations. Before moving forward with a trust, consider working with a professional who is familiar with the rules and regulations.

Donor-advised Funds

Some people are comfortable with their current gifting strategies. Others, however, may want a more advanced strategy that can maximize their gift and generate potential tax benefits. A financial professional can help you assess which approach may work best for you.

Remember, the information in this article is not intended as tax or legal advice. And it may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation.

Fast Fact

Contributions by individuals, couples, and families accounted for 71% of the $373.25 billion donated to charitable organizations in 2015.

Source: Giving USA Foundation, 2016

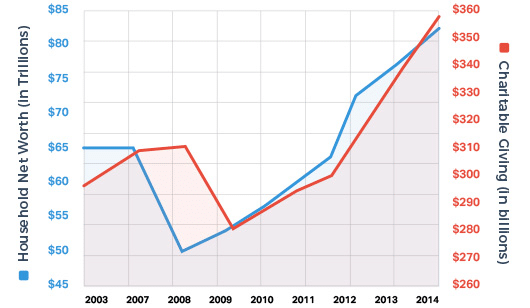

Chart Source: Giving USA Foundation, 2016; Federal Reserve, 2016

Giving and Net Worth

Charitable giving appears to trail household net worth by about one year. When household net worth dipped in 2008, charitable giving dipped in 2009.

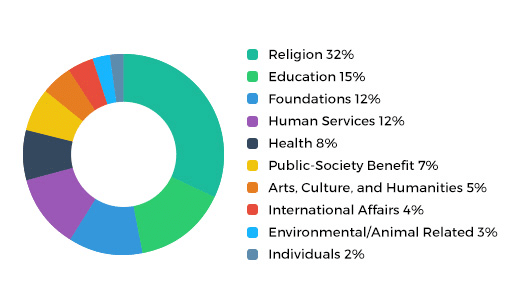

Where the Money Goes

The biggest percentage of charitable contributions (32%) went to churches and religious organizations. A variety of different types of groups were on the receiving end of charitable gifts.

Chart Source: Giving USA Foundation, 2016; Federal Reserve, 2016