Estate Planning

Estate planning is a confusing yet critical element in the financial planning process.

In partnership with an estate planning attorney, your Wealth Alliance Advisor can help you navigate questions concerning establishing a trust and a will, naming an executor of your estate and more. Regardless of your net worth, it’s critical to understand your choices when developing an estate strategy.

Estate Management Checklist

Here are some initial questions to ask yourself before talking with one of our advisors. Remember, we’re here every step of the way!

Do you have a will?

Do you have healthcare documents in place?

Do you have financial documents in place?

Have you filed beneficiary forms?

Do you have the right amount and type of life insurance?

Have you taken steps to manage your federal estate tax?

Have you taken steps to protect your business?

Have you created a letter of instruction?

Will your heirs be able to locate your critical documents?

Your heirs will need access to the specific documents you have created to manage your estate. These documents may include:

- Your will

- Trust documents

- Life insurance policies

- Deeds to any real estate, and certificates for stocks, bonds, annuities

- Information on your bank accounts, mutual funds, and safe deposit boxes

- Information on your retirement plans, 401(k) accounts, or IRAs

- Information on any debts you have: credit cards, mortgages and loans, utilities, and unpaid taxes

Note: Power of attorney laws can vary from state to state. An estate strategy that includes trusts may involve a complex web of tax rules and regulations. Consider working with a knowledgeable estate management professional before implementing such strategies.

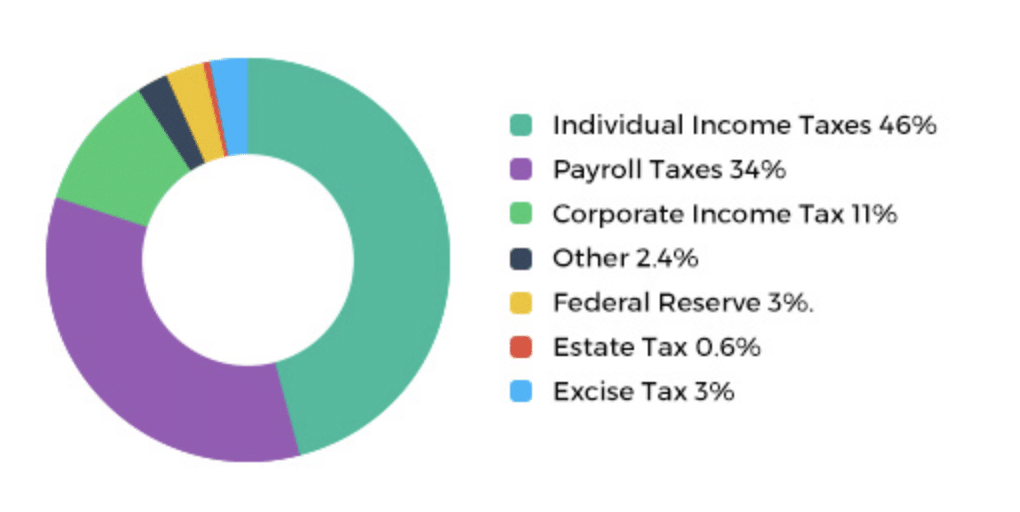

Estate Taxes and Overall Federal Revenues

Estate taxes typically account for less than one percent of total federal revenue.

Chart Source: Center on Budget and Policy Priorities, 2015

Critical Estate Documents

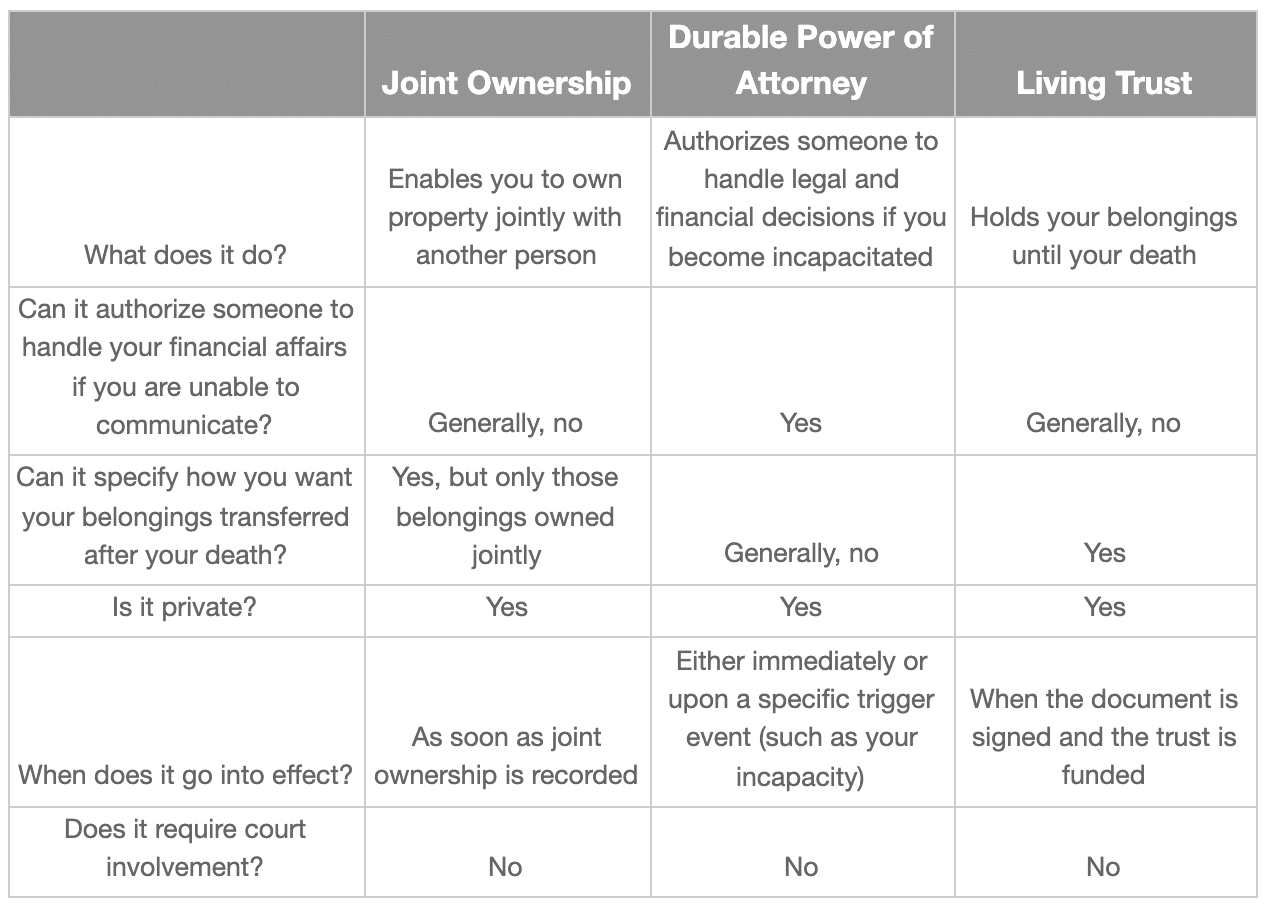

Financial Documents

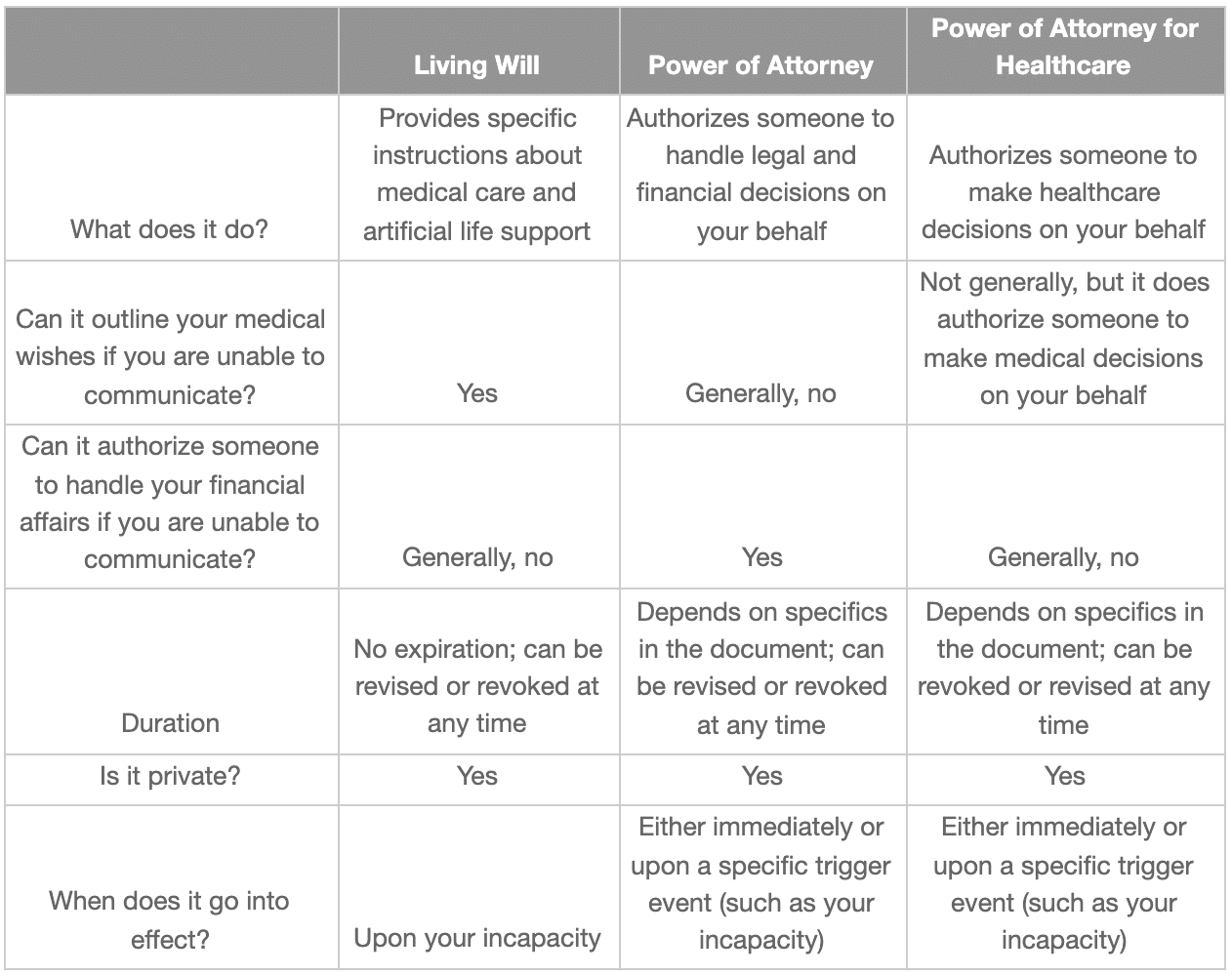

Healthcare Documents