Social Security

When to Take Social Security

The U.S. Government’s Social Security program allows you to start receiving benefits as soon as you reach age 62. The question is, should you?

The team at Wealth Alliance is here to help you figure that out, but here are a few things to consider.

Monthly payments differ substantially depending on when you start receiving benefits. The longer you wait (up to age 70), the larger each monthly check will be. The sooner you start receiving benefits, the smaller the check.

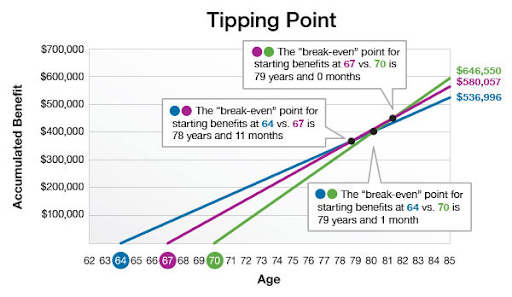

From the Social Security Administration’s point of view, it’s simple: If a person lives to the average life expectancy, the person will eventually receive roughly the same amount in lifetime benefits no matter when he or she chooses to start receiving them. In actual practice, it’s not quite that straightforward, but the principle holds.

The key phrase is “if the person lives to average life expectancy.” If a person exceeds the average life expectancy, and has opted to wait to receive benefits, he or she will start to accumulate more from Social Security.

The chart shows how Social Security benefits accumulate for individuals who started to receive at ages 62, 67, and 70. The person who started to receive benefits at age 62 would accumulate $620,064 by the age of 85. Conversely, the person who started to receive benefits at age 70 would accumulate $679,296 by the age of 85.

The example assumes the maximum retirement benefit of $2,687 at age 66. It does not assume COLA.

If you have a spouse, the decision about when to start benefits gets more complicated—particularly if one person’s earnings were considerably higher than the other’s. The timing of spousal benefits should be factored into a decision.

When considering at what age to start Social Security benefits, it may be a good idea to review all the assets you have gathered for retirement. Some may want the money sooner based on how assets are positioned, while others may benefit by waiting. So as you near a decision point, it may be best to consider all your options before moving forward.

Source: Social Security Administration, 2017

Three Key Questions to Answer Before Taking Social Security

Social Security is a critical component of the retirement financial strategy for many Americans, so before you begin taking it, you should consider three important questions. The answers may affect whether you make the most of this retirement income source.

Remember, our team is a resource for any questions you may have!

When to Start?

Should I Continue to Work?

How Can I Maximize My Benefit?

Five Social Security Facts You Need to Know

Social Security can be complicated and, as a result, many individuals don’t have a full understanding of the choices they may have, so here’s what you need to know.

Social Security Is a Critical Source of Retirement Income

Keep in mind that Social Security makes annual cost of living adjustments based on the Consumer Price Index and, under current laws, pays income for life and the life of your spouse.[4]Social Security Administration, September 2016

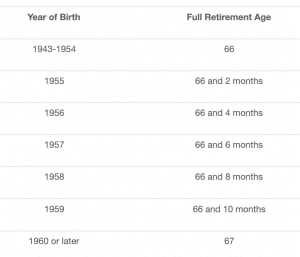

There’s Flexibility for When you Can Begin Receiving Benefits

Important Note

Though full retirement age varies, you also may want to consider applying for Medicare benefits three months before your 65th birthday; if you wait longer, your Medicare medical insurance and prescription drug coverage could cost you more.

Welcome to EditPad.org – your online plain text editor. Enter or paste your text here. To download and save it, click on the button below.

You may begin receiving benefits as early as age 62, though your benefits will be reduced at a rate of about one-half of 1% for each month you begin taking Social Security before your full retirement age.[5]Social Security Administration, September 2016

You may choose to delay receiving benefits until after attaining your full retirement age, in which case, your benefits are scheduled to increase by 8% annually. This increase under current law will be automatically added each month from the moment you reach full retirement age until you start taking benefits or reach age 70—the age at which these delayed retirement credits stop accruing. Plus, your benefit also will increase by any cost of living adjustments applied to benefit payment levels during that time.[6]Social Security Administration, September 2016

If you plan on continuing to work, you may still receive the full benefit for which you are eligible. Indeed, working beyond full retirement age can increase your benefits. However, your benefits will be reduced if your earnings exceed certain limits. If you work and start receiving benefits before full retirement age, your benefits will be reduced by $1 for every $2 in earnings above the prevailing annual limit ($16,920 in 2017).[7]Social Security Administration, September 2017

If you continue to work during the year in which you attain full retirement age, your benefits will be reduced by $1 for every $3 in earnings over a different annual limit ($44,880 in 2017) until the month you reach full retirement age.

Once you have attained full retirement age, you can keep working and your benefits under current law will not be reduced, regardless of how much you earn.

As you can see, the decision of when to begin taking Social Security is a critical one.

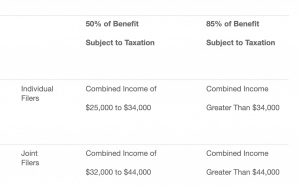

Social Security May Be Taxable

Will Your Social Security Benefits Be Subject to Federal Income Taxes?

This potential income tax exposure may have substantial implications for whether you choose to work in retirement, how your assets are invested, and the timing of withdrawals from other retirement accounts.

For instance, a withdrawal from a traditional IRA may lift your income beyond the thresholds described above, subjecting a higher proportion of your Social Security to income tax.[8]Withdrawals from traditional IRAs are taxed as ordinary income and, if taken before age 59½, may be subject to a 10% federal income tax penalty. Generally, once you reach age 70½, you must begin … Continue reading

The same is true of investment earnings in non-retirement savings. Retirees who have investment earnings in excess of their current spending needs may be subjecting their Social Security income to taxation. Shifting a portion of those assets to a tax-deferred instrument, such as an fixed annuity, may be one way to manage taxation on your Social Security benefit. [9]The guarantees of an annuity contract depend on the issuing company’s claims-paying ability. Annuities have contract limitations, fees, and charges, including account and administrative fees, … Continue reading

Social Security Can Be a Family Benefit

Benefits may also be paid to your unmarried children if they are younger than 18 or between 18 and 19 and enrolled in a secondary school as a full-time student, or if they are age 18 or older and severely disabled.

Each family member may be eligible for a monthly benefit that is up to half of your retirement (or disability) benefit amount. There is a family limit, which varies, but is generally between 150% to 180% of your retirement (or disability) benefit.[10]Social Security Administration, September 2016

When you die, your family may be eligible for benefits based on your work record. Family members who qualify for benefits include:

- Widow or widower

- age 60 or older;

- age 50 and older if disabled; or

- any age if he or she is caring for your child who is younger than 16 or disabled and entitled to Social Security benefits on your record.

- Unmarried children can receive benefits if they are:

- under 18 years of age;

- between 18 and 19 and are full-time students in a secondary school; or

- age 18 or older and severely disabled (the disability must have started before age 22).

Your survivors receive a percentage of your basic Social Security benefit—usually in the range of 75% to 100% for each member, though the limit paid to each family is about 150% to 180% of your benefit rate.

A Divorced Spouse May Be Eligible for Benefits

- have been married to your ex-spouse for at least 10 years;

- have been divorced two years or longer;

- be at least 62 years old;

- be unmarried; and

- not be entitled to a higher Social Security benefit based on your own work history.

If your former spouse is deceased, you may still receive benefits as a surviving divorced spouse (irrespective of the age he or she died), assuming that your ex-spouse was entitled to Social Security benefits, your marriage was at least 10 years, you are at least 60 years old and you are not entitled to a higher benefit amount based on your own work history. If you remarry before the age of 60, you will lose the ability to receive a survivor benefit from your deceased ex-spouse.

If your former spouse is living, the maximum amount that you are eligible to receive is 50% of what your former spouse is due at full retirement age. To receive the maximum benefit, you will need to wait until you have reached your own full retirement age.[11]Social Security Administration, September 2016

Your benefits are unaffected should your former spouse elect to take Social Security before reaching full retirement age or if your ex-spouse starts a new family.

How to Maximize Your Social Security Benefits

Waiting to claim Social Security benefits can result in higher monthly payments. However, many don’t know that there are other ways to maximize their benefits, some of which depend on their marital status.

Understanding the strategies for maximizing your Social Security retirement income benefits should be prefaced with a review of the three basic forms of retirement benefits:

The Worker Benefit

This is the benefit you receive based on your own personal earnings history, and for which you become eligible after 40 quarters of work.

The Spousal Benefit

This is the benefit paid to your spouse. For non-working spouses, this is 50% of the working spouse’s benefit. For working spouses, it is the greater of the benefit earned from his or her earnings or 50% of the worker’s benefit.

The Survivor Benefit

This is the benefit paid to the surviving spouse, which is paid at a rate equal to the greater of his or her own current benefit, or the deceased spouse’s current benefit.

References

| ↑1 | Social Security Administration, 2017 |

|---|---|

| ↑2 | Social Security Administration, 2017 |

| ↑3 | Social Security Administration, September 2016 |

| ↑4 | Social Security Administration, September 2016 |

| ↑5 | Social Security Administration, September 2016 |

| ↑6 | Social Security Administration, September 2016 |

| ↑7 | Social Security Administration, September 2017 |

| ↑8 | Withdrawals from traditional IRAs are taxed as ordinary income and, if taken before age 59½, may be subject to a 10% federal income tax penalty. Generally, once you reach age 70½, you must begin taking required minimum distributions. |

| ↑9 | The guarantees of an annuity contract depend on the issuing company’s claims-paying ability. Annuities have contract limitations, fees, and charges, including account and administrative fees, underlying investment management fees, mortality and expense fees, and charges for optional benefits. Most annuities have surrender fees that are usually highest if you take out the money in the initial years of the annuity contact. Withdrawals and income payments are taxed as ordinary income. If a withdrawal is made prior to age 59½, a 10% federal income tax penalty may apply (unless an exception applies). |

| ↑10 | Social Security Administration, September 2016 |

| ↑11 | Social Security Administration, September 2016 |